Insurance Blog

Please read our blog about a wide variety of insurance topics. Please feel free to ask us any questions.

Am I Covered When I Lend My Car To Friends Or Family?

Posted: July 3, 2019

If you own a car, chances are you’ve let a friend or family member borrow it at least once. After all, there are plenty of reasons to hand over the keys. Maybe you needed a relative to pick up your kids from school. Or you’re helping someone get to work after their car broke down. But did you know that in the event of an...

How To Lower Your Homeowners Insurance Costs

Posted: July 2, 2019

If you own a home, homeowners insurance is an item in your budget that’s there to stay. Depending on the size of your home, location, and other factors, your premiums may be significant and could increase over time. However, there are ways to minimize the cost of homeowners insurance. Taking the following steps could help lower your premiums. Increase Your Deductible A deductible is the...

Best Uses For Special Event Insurance

Posted: June 20, 2019

In today’s litigious society, it may be wise to consider purchasing special event insurance if you are planning a wedding, a large party, or another event. This type of insurance can help protect your investment in the event and provide liability coverage for various types of potential claims. Speak with our friendly, helpful agency about an insurance policy to cover your special event. What Is...

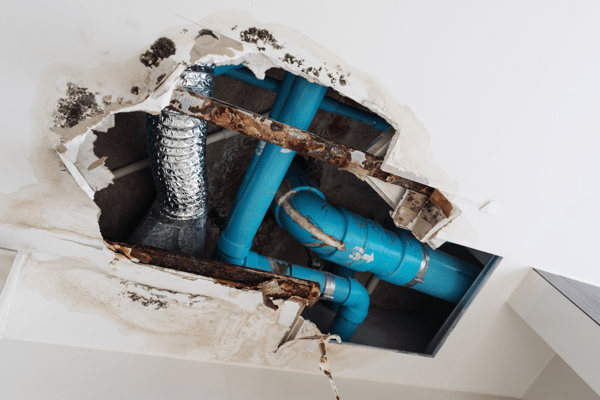

Does My Homeowners Insurance Cover Internal Damage?

Posted: June 18, 2019

When they think of homeowners insurance, many people have fires, storms, and natural disasters in mind. But what about internal damage, such as water leaks and mold? Are these problems covered? Your policy is likely to cover certain types of internal damage, but not all. Our knowledgeable agency will be happy to review your homeowners insurance policy and ensure you are covered for any eventuality....

Yep! Accidents Happen. (Then What?)

Posted: June 17, 2019

You pride yourself on being a good driver. You drive defensively, avoid texting and other distractions, take safety precautions, and keep your car in good shape. Still, accidents can happen. And when they do, you’re faced with the question: What now? For Erie Insurance customers, the best first step is to seek the advice of an expert: your ERIE agent. See also: 6 Reasons You’ll...

Oops! We could not locate your form.